Fixed Annuities

A fixed annuity is an insurance contract that guarantees (backed by the insurance companies ability to pay) payments to the buyer at an agreed upon guaranteed interest rate on contributions to the account.

A variable annuity pays interest that can fluctuate based on the performance of an investment portfolio chosen by the account`s owner typically in mutual funds.

We don`t sell variable annuities. See Y we don`t sell variable insurance products.

The gains with a fixed annuity are tax deferred until the owner begins receiving income from the annuity. One can buy a fixed annuity with a lump sum of money or with a series of payments over time. The insurance company provides a guaranteed rate of interest. This time frame is called the period.

When the annuity owner, called the annuitant, starts to receive regular income from the annuity, the insurance company bases those payments on the amount of money in their account, an owner`s age, and the period of time the payments will last. This begins the payout period. The payout period might last for a specified number of years or it could be for the rest of the owner`s life. The owner has a myriad of payout options full annuitization is only one.

The rest of your life period is called a full annuitization. In the old days they used to say every time an annuity was annuitized a cannon went off on the front lawn of the insurance company as they won the battle. The basis of that is full annuitization is a battle with the insurance company that you will live a long time and be paid in money`s that exceed your contributions to the annuity/insurance company.

Where with full annuitization if you die sooner the insurance company keeps what money`s you left behind. Today, most people don`t choose full annuitization. The simple reason is more people understand this and the fact of the matter is they do not know how long they will live. They don`t like the idea of leaving money on the table for the insurance company. It is sort of like activating your Social Security. It`s difficult as you don`t know how long you are going to live.

During the accumulation period, the account grows tax deferred. It is called the an exclusion ratio which is a fancy way of saying you do not pay taxes on what you contributed only on the gains the account accrued.

However, in a qualified annuity, annuities bought in a qualified retirement plan such as a 401K the entire payment would be subject to taxes. Because everything in the plan was already tax deferred!

We do not believe in buying an annuity in a tax deferred account. While your legislators sell influence to the insurance industry to allow this it makes no sense. Any retirement plan that is qualified is tax deferred and set up for everything in the plan is already tax-deferred so you really don`t need to have an annuity in such a plan.

You can buy an annuity when you retire and start taking distributions from the plan for a guaranteed income for life but it is not recommended during the growth stage of your working career. While you have insurance agents masquerading as financial advisors our opinion is they are just insurance salespersons. A real (RIA) Registered Investment Advisor would probably not do this.

Unlike life insurance fixed annuities are an investment and a very safe one at that. While the actual returns will not compete with stock market index returns over time they are on a par with safety much like a Government bond. In fact in today`s inflation riddled environment and the huge debt the US Treasury has some might consider an insurance companies annuity safer than a Government. Bond.

In our minds for risk-adverse investors a fixed annuity makes more sense than a Government Bond. The US bond only pays interest through maturity but does not have any annuitization you simply get the interest accrued plus the price of the bond. However, it may not be the price you paid for the bond as bond prices go up when interest rates go down and bond prices go down when interest rates go up. So I that sense an annuity is safer than a government bond. One savvy mutual fund manager once said, If a money manager predicted interest rates correctly he was probably lucky.

Keep in mind just in case of a recession / depression or even a reset in currency the insurance companies made it through the depression Wall Street did not. Also, it would be good to know what insurance companies failed in the 2008 great recession mortgage meltdown.

An annuity is simple compared to buying stocks or bonds. You choose an insurance company first on their ability to pay. How long they have been In business, their rating, how they fared in 2008 and of course the interest rate they are guaranteeing.

DISADVANTAGES

Regardless of the annuities be it fixed or variable, they are mostly illiquid. They allow one withdrawal per year of up to 10% of the account value. This may make them a bad choice for money that may be needed for an emergency. So, don`t put your rainy-day emergency fund into an annuity.

Annuities have a surrender period, which is the period that if you take too much money out in distributions you can see penalties and/or additional tax penalties depending on age.

Annuities are an insurance product that can have higher fees compared to other investments. The only other investment to compare them to is Government Bonds. When it comes to safety there are not a lot of choices.

CD`s, Government treasuries / bonds and annutities. Gold is more illiquid and volatile. Crypto was never a safe investment. An annuity is generally considered a very safe investment. If you would like to take a look contact us.

Insurance companies made through the depression not so for wall street.

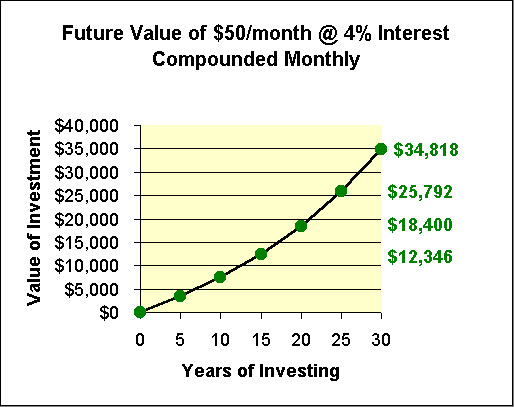

If it bothers you that now insurance companies can invest in the stock market it should but we control what we can. Even in 2008 most insurance companies did well. The ones who followed the age old rule; no more than 10% of your portfolio into one investment asset class. The insurance companies that over positioned themselves in risky derivatives are the ones that needed a taxpayer bailout. One thing this graph shows is it don’t take much over time to build a little nest egg.